Blog

Transgenerational Wealth – Estate and Succession Planning

– Saumil Shah

In the western world, some of the more successful families have reached third or fourth generations in business. Asia holds one-third of the global wealth and with the business boom in the 80’s, many business families are at the crossroads of significant wealth transition- not only to continue their legacy but encourage multi-generational growth whilst maintaining harmony within the family/extended family. India is no different as the baton of successful businesses passes from first generation patriarch to their children or grandchildren for the first time since liberalization.

Succession planning is not a one-time transactional approach of passing on assets to the next generation in a tax efficient manner. It is often confused with inheritance (estate) tax planning or forming a generation skipping trust to transfer wealth from a grantor directly to the grantors’ grandchildren.

Succession planning seeks to achieve:

- Protection of family wealth from unforeseen events, disputes and contingencies;

- Alignment of economic interest and management control of various businesses and streamline shareholding and voting rights;

- Segregation of business assets, financial assets, realty assets, lifestyle maintenance corpus and philanthropy corpus;

- Ownership/control of assets is transferred to successive generations as desired;

- Continuity of business with flexibility for future exits;

- Effective flow of income to current and future generations for maintenance of lifestyle especially for disabled or incapacitated members, education, special occasions, new businesses or charity.

Family, ownership and business are the three important but interdependent dimensions in succession planning. Balancing family complexity, owners / shareholders returns and competitive business landscape requires a carefully orchestrated multi-year succession process.

Family charter or a constitution or a family agreement though not legally binding sets out the principles and aspirations of the family and aids in unifying and reinforcing common intent in families in times of conflict. As the family expands, separation of ownership from management of business is inevitable. Ownership rights such as voting rights, right to appoint board of directors etc. can still be exercised by a representative group elected by the family members, whereas management of business can be best left to the persons best qualified either within the family circle or to professionals outside of the family.

There are various succession planning methods that have been time tested.

Shareholders agreement is one such tool that ensures that family co-owners are “joined to the hip”. It sets out the rules of ownership viz exercise of voting rights, inter-se transfer of shares, valuation methodology, retirement, dispute resolution etc.

Private family trusts are often suggested for transfer of intergenerational wealth. Benefits of private family trusts is diagrammatically represented below:

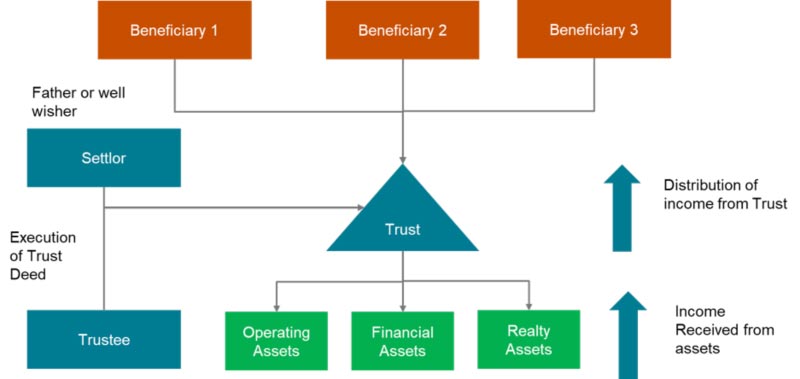

Though trust laws in India are dated, the trust structure offers ease in separation of ownership and control from the economics attached to that assets, maximum flexibility in determining method of future distribution, increased confidentiality and avoidance of probate procedures. The patriarch of the family can decide which assets are to be transitioned to the next generation, migrate those assets into the trust, retain control of them as a trustee and distribute annual income or accumulations in a trust to the desired beneficiaries. A trust is not a legal entity but a fiduciary relationship defined by the settlor between a trustee and the beneficiaries. This relationship is codified by the settlor in a document called trust deed. There are no set rules for a trust deed and therefore drafting of it can be as simple or complex as the settlor can envisage. The trust deed governs the administration of the trust, sequence of trustees, management philosophy of the underlying assets, distribution rules of the trust funds to the beneficiaries amongst other features. A trust can be for a definite period or structured for perpetuity.

Typical constituents of a private family trust are depicted below:

With frequent amendments to the Indian tax rules, the tax rules applicable to a private family trust are quite complex. The tax consequences must be evaluated at the time of settlement of assets into a trust, income earned on these assets by the trust and ultimate distributions from the trust funds to the beneficiary. Taxation of trusts would fundamentally depend on whether it is characterized as a revocable or an irrevocable trust, discretionary or a non-discretionary (specific) trust. It could get further be complicated if the trust deed is drafted as specific for corpus and discretionary for income. In additional the regulatory implications also must be considered while migrating assets into a trust.

If the assets under question are shares of listed companies, then SEBI Takeover Code would also apply and needs to be evaluated whether there is de-facto change in control. If there are immovable properties, then state specific stamp duty implications must be considered. The situs of management and control of a trust would be deemed to be in India if the trustee is a resident of India. Thus a private family trust domiciled in a foreign jurisdiction must never have a trustee that is a resident of India, else the income of that trust would be taxable in India. Conversely, RBI permission would be required if a distribution from an Indian trust is envisaged to a foreign resident. It may not be possible for an Indian trust to own a foreign asset under trust, whereas a foreign trust can own an Indian asset if structured properly. Further there are reporting obligations on the individuals in India if he owns any foreign asset or is a trustee or a beneficiary of a foreign trust. Thus each family would have their own situations and complexities that need to be dealt with individualistically and unconventionally while drafting the trust deed and there are no “one size fits all” solutions.

Even if there is a well-structured trust or other arrangements in place for a complex succession plan, a Will must be drafted to accommodate transfer of any residual asset that may be left behind in personal name to the legal heirs or nominees as the case may be.

With the ballooning of liquid portion of wealth, financial management of a family corpus necessitates establishment of a family office. A family office can be formed as a corporate entity, LLP or a trust depending on tax and operational considerations. Large family offices could very well justify to be professionally managed considering the size of the corpus and the required expertise to invest in India as well as abroad and in different asset classes. Creation of family office is an integral part for continuity in succession planning. To conclude succession planning is a complex and a continuous process. Success of any planning is as much dependent on family’s preparedness as it is on proficient legal and tax advice. Families who have a unified sense of long term vision, collaborative approach, robust governance tools are more likely to succeed in intergenerational wealth migration.

About The Author

Credits: Saumil Shah, Chartered Accountant and Director, Economic Laws Practice (ELP).